Things about Real Estate Reno Nv

Things about Real Estate Reno Nv

Blog Article

Examine This Report on Real Estate Reno Nv

Table of ContentsReal Estate Reno Nv Fundamentals ExplainedThe Single Strategy To Use For Real Estate Reno NvThe Main Principles Of Real Estate Reno Nv Real Estate Reno Nv Fundamentals ExplainedThe Ultimate Guide To Real Estate Reno Nv3 Simple Techniques For Real Estate Reno Nv

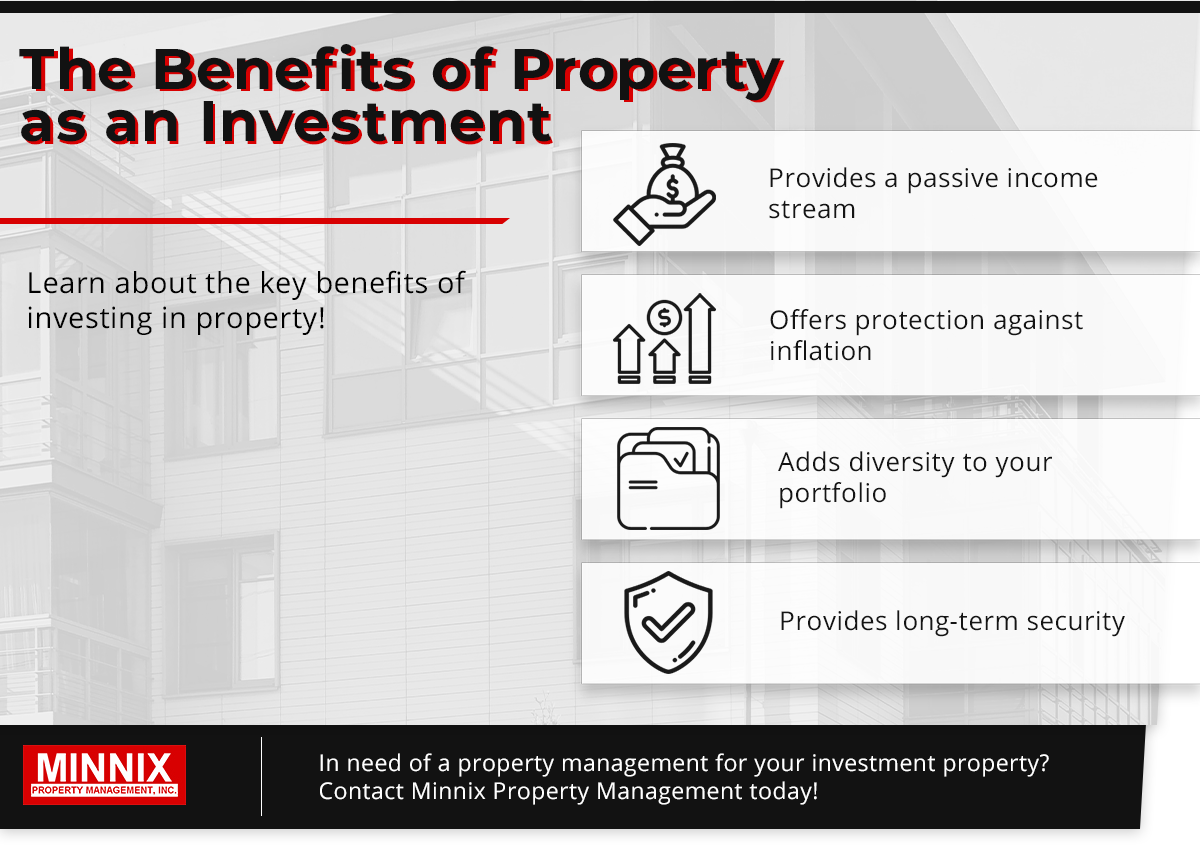

The advantages of spending in realty are various (Real Estate Reno NV). With appropriate possessions, capitalists can delight in predictable capital, superb returns, tax obligation advantages, and diversificationand it's feasible to take advantage of property to construct wealth. Thinking regarding investing in real estate? Below's what you require to learn about property advantages and why property is considered an excellent financial investment.

The advantages of investing in actual estate include passive revenue, steady cash money circulation, tax obligation benefits, diversification, and take advantage of. Property financial investment counts on (REITs) supply a method to invest in actual estate without having to own, run, or money homes. Money circulation is the earnings from a realty investment after mortgage payments and overhead have actually been made.

Property worths tend to raise in time, and with a great investment, you can turn a profit when it's time to sell. Rental fees likewise often tend to climb with time, which can cause higher capital. This graph from the Reserve bank of St. Louis reveals median home costs in the united state

An Unbiased View of Real Estate Reno Nv

The areas shaded in grey suggest U.S. economic crises. Mean Prices of Residences Cost the USA. As you pay down a building home mortgage, you build equityan possession that belongs to your web well worth (Real Estate Reno NV). And as you build equity, you have the take advantage of to get even more residential or commercial properties and raise capital and riches even more.

Property has a lowand in some situations negativecorrelation with other major possession courses. This suggests the enhancement of realty to a profile of diversified properties can reduce profile volatility and provide a greater return each of threat. Utilize is the usage of different economic tools or borrowed capital (e.

The Best Strategy To Use For Real Estate Reno Nv

As economies increase, the need genuine estate drives leas greater. This, in turn, equates into higher funding values. For that reason, property often tends to preserve the purchasing power of resources by passing some of the inflationary pressure on occupants and by integrating some of the inflationary stress in the form of capital appreciation.

There are numerous means that having property can safeguard versus rising cost of living. First, home values might climb greater than the price of rising cost of living, bring about capital gains. Second, rents on investment buildings can enhance to maintain up with rising cost of living. Homes financed with a fixed-rate car loan will certainly see the relative amount of the monthly home mortgage repayments fall over time-- for instance $1,000 a month as a set settlement will certainly become much less difficult as rising cost of living erodes the buying power of that $1,000.

One can profit from marketing their home at a rate greater than they paid for it. And, if this does occur, you may be accountable to pay tax obligations on those gains. In spite of all the advantages of buying genuine estate, there are drawbacks. Among the major ones is the absence of liquidity (or the relative difficulty in converting a property into cash money and money web into an asset).

The Main Principles Of Real Estate Reno Nv

Why spend in actual estate? The truth is, there are several actual estate advantages that make it such a prominent choice for seasoned capitalists.

Equity is the value you have in a property. Over time, regular payments will eventually leave you having a property cost-free and clear.

Real Estate Reno Nv - An Overview

Anyone that's shopped or loaded their container just recently understands just how inflation can destroy the power of hard-earned cash. Among one of the most underrated property benefits is that, unlike many typical investments, property worth tends to rise, even during times of significant inflation. Like various other important assets, realty commonly maintains value and can consequently work as a superb place to invest while greater costs consume away the gains of different other financial investments you may have.

Admiration refers to money made when the overall value of an asset rises in between the moment you buy it and the time you offer it. Genuine estate, this can imply considerable gains due to the usually high prices of the assets. It's crucial to remember recognition is a single point and just offers discover this cash when you offer, not along the method.

As mentioned earlier, capital is the cash that begins a regular monthly or yearly basis as an outcome of possessing the home. Commonly, this is what's left over after paying all the essential costs like home loan payments, repair work, taxes, and insurance coverage. Some properties might have a substantial money flow, while others may have little or none.

Real Estate Reno Nv - Truths

Brand-new capitalists might not absolutely recognize the power of take advantage of, however those that do open the potential for huge gains on their financial investments. Usually talking, leverage in investing comes when you can own or control a bigger amount my latest blog post of assets than you might or else spend for, through the usage of credit.

Report this page